There is one thing that leaves me discouraged about the state of our country, and that is what this blog post is about. Ironically, I wrote a blog post almost a year ago to the day in response to Dave Lieber’s “Everyone Should File a Protest” Campaign / Article in the Dallas Morning News, and we agreed […]

Category: Property tax

Money Isn’t the Real Reason Everyone Should Protest Their Property Taxes

Dave Lieber, who is better known as The Watchdog, of Dallas Morning News has launched a “Everybody File a Protest” Campaign using his platform with the media channel in the DFW area. You can read the article here. While RealValueIQ agrees with The Watchdog’s overall campaign – specifically that of everyone should file a protest […]

What The Texas Property Tax Relief Act (SB2) Means to You

The majority of homeowners should like Senator Paul Bettencourt’s Property Tax Relief Act being passed by the Senate narrowly 5-4 on Monday as a positive, strictly when it comes to the property tax appeals system. It will only be positive, however, if the current three year trend continues when it comes to the number of […]

Debunking Property Tax Myths #1

Myth #1: Protesting Your Property Taxes Can Put You at Risk For an Increase in Property Taxes There are some common misconceptions about the property tax appeal process that I often hear from property owners who are not familiar with the property tax appeal process. For this reason we decided to create a series of […]

Property Tax Two Step: Why You Should Always Protest and Why You Should Do It Yourself

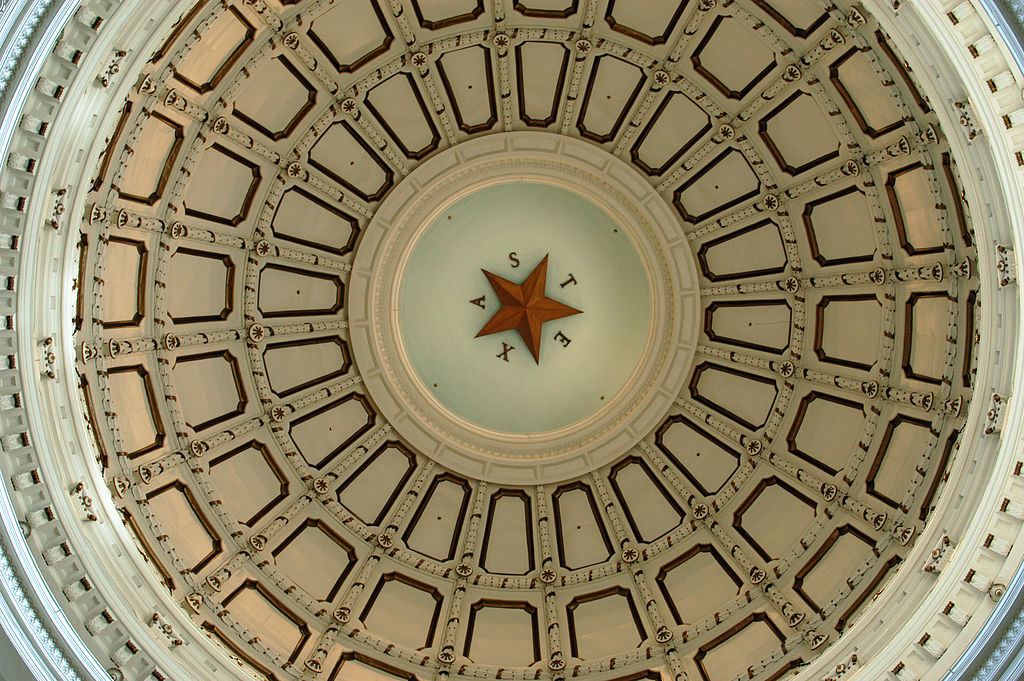

The content of this blog post will use statistics taken from the Travis Central Appraisal District from the 2014 Property Tax Season. The article containing these statistics was found in the Austin American Statesman on May 9th, 2015. RealValueIQ highly recommends reading the article in addition to this blog post, especially if you own a […]

Why Is The RealValueIQ Report Important?

The RealValueIQ report matters because it gives you, the property owner, the information you need to effectively protest your proposed taxable value. In order to understand the value of the RealValueIQ Report, we must first look at the options a property owner has in Texas when protesting their value to demonstrate inequality and receive tax […]

Your Taxpayer's Bill of Rights

As a homeowner, the Texas constitution grants you these rights: You have the right to equal and uniform taxation. You have the right to ensure that your property is appraised uniformly with similar property in your county. You have the right to have your property appraised according to generally accepted appraisal techniques and other requirements […]

Why Equity Isn't What You Think It Means

Equity is often thought of by property owners as the “equity” they have in their home – but this is not the definition used by the state of Texas when it comes to property taxes. Equity – as it relates to your property taxes – means the Texas constitutional requirement that every property has the […]